By Christophe de la Celle, Head of UK Office & Global Business Development – HedgeGuard

Scaling up. Unlocking “operational alpha”. Building an institutional investor and regulator proof infrastructure. These are all key considerations at the forefront of fund managers’ agendas. New technology has allowed funds to achieve increased operational efficiencies which have fed into front office performance. The Portfolio Management System (“PMS”) has been at the heart of this evolution with managers benefiting from streamlined processes and enhanced analytics.

However, searching for a new Portfolio Management System can be a daunting and overwhelming endeavour. There are a multitude of offerings available in what is a broad and competitive market. Each system has their own set of functionalities and features and it can prove difficult to narrow down your search.

So how does one identify the best Portfolio Management Software for their fund? At HedgeGuard we work with a wide range of different clients, from Hedge Funds, Asset Managers and Family Offices. Although each client has specific requirements it is possible to build a more general summary of the starting points to focus on. As you begin your research of your new financial software and enter the world of fintech, we highlight some of these key focus points below.

ASK AROUND

Where to start? You can kick off your due diligence process with some of your own research as there is a plethora of information available on the net. Online Portfolio Management System directories such as Bob’s Guide or Capterra will list some of the main PMS providers. In addition to independent buyside consultants that will provide valuable industry insight, some of the best feedback will come from your own network, speaking to those who use PMS software daily such as fund Portfolio Managers and Operational staff members. Of course, once you’ve narrowed down your search, don’t hesitate to ask your service provider for existing client references.

LOOK FOR FLEXIBILITY

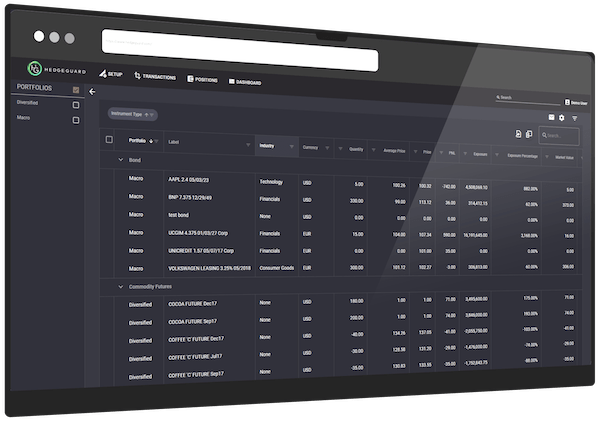

There is always a learning curve involved with using a new software. But how far can you tailor your new system to suit you? During your search, you will come across various new interfaces. Take a step further and explore the customisable options they offer. Can you tailor, save and share your own portfolio views? How easy is it to add new criteria, or create your own bespoke ones? Can you build and run bespoke analysis that quickly allows you to view your portfolio from multiple angles? These are all key questions to ensure you can build an environment within your Portfolio Management System that is catered to your own approach.

UNDERSTAND THE WORKFLOW

Diving into the PMS’ architecture, it is key to understand how the workflow has been conceived. Has it been designed with, ideally, a front to back mindset? From portfolio construction, analysis, order and risk management, to cash management and compliance, how do the different modules interact with each other? Aim to identify workflows that will be seamless.

IDENTIFY THE BEST FIT

As any professional racer would tell you, there is no point in having the best engine if it doesn’t fit with the chassis. The same goes for Portfolio Management Software. During your due diligence process, it is key to understand how the PMS will sit within your current set-up. What are its connectivity capabilities to your existing counterparts (Prime Brokers, Custodians, Administrators)? Is it possible to tailor the system’s user rights depending on the profile of the user (E.g. a risk manager can ultimately approve blocked trades, intern with read-only rights etc.)? Can the PMS connect with some of my existing dealing interfaces? You will want to avoid technical barriers and time consuming tasks by ensuring that your PMS can easily adapt to your existing environment and not the other way around.

As any professional racer would tell you, there is no point in having the best engine if it doesn’t fit with the chassis. The same goes for Portfolio Management Software. During your due diligence process, it is key to understand how the PMS will sit within your current set-up. What are its connectivity capabilities to your existing counterparts (Prime Brokers, Custodians, Administrators)? Is it possible to tailor the system’s user rights depending on the profile of the user (E.g. a risk manager can ultimately approve blocked trades, intern with read-only rights etc.)? Can the PMS connect with some of my existing dealing interfaces? You will want to avoid technical barriers and time consuming tasks by ensuring that your PMS can easily adapt to your existing environment and not the other way around.

OPTIMISE OPERATIONS

A frequent point underlined in our conversations with fund managers is how to enable their operational staff to focus on high value tasks rather than time consuming ones. At HedgeGuard we have built an outsourced middle office service for our clients that works as our internal “test-lab”, identifying and resolving the operational pain fund managers feel daily. We are the first clients of our own PMS as the team are all trained to be experts on the software. This has allowed us to build operational modules in the PMS that cover the full operational cycle. These points tie into the workflow question mentioned above as it is important that your PMS tool covers operational features such as NAV, cash reconciliation as well as cash management, subscription and redemptions.

CHOOSE THE RIGHT TEAM

Services providers should be viewed as an extension of your team, and not an entity simply selling you a product. It is important to quantify the level of support and training received once you have selected a Portfolio Management System. What are the team’s backgrounds? How knowledgeable are they on both the product and the strategies and products you trade? What type of turnaround time can you expect from requests. Can support be provided online, over the phone or in person?

SCALE WITH CONTROL

There will be the absolute level of cost, but it is essential to consider how this will evolve with your growth. What is the pricing structure, is it a flat fee or AUM dependent? What are the terms, am I locked in for X years or is the contract flexible? Are there any hidden costs? What modules/number of users are included in the base offering? Is there a cost involved for additional modules or bespoke development requests?

There are many points to consider during your search for a new PMS, hopefully the above will provide you with some helpful guidelines.