Overview

Extend your team, boost your activity with our Hedge fund Middle Office Outsourcing Service

Our Middle Office team speaks your language. We were born within the industry: we understand your fund from all sides, from your operational requirements to your investors’ expectations. We become your day to day partner, we evolve with you to always respond to your needs. As an extension of your team, we back your operations to let you focus on generating alpha.

« HedgeGuard brought a unique combination of PMS and middle-office services that perfectly complements our operations. »

Guillaume Dermer, Metori

Our Middle Office Outsourcing Service

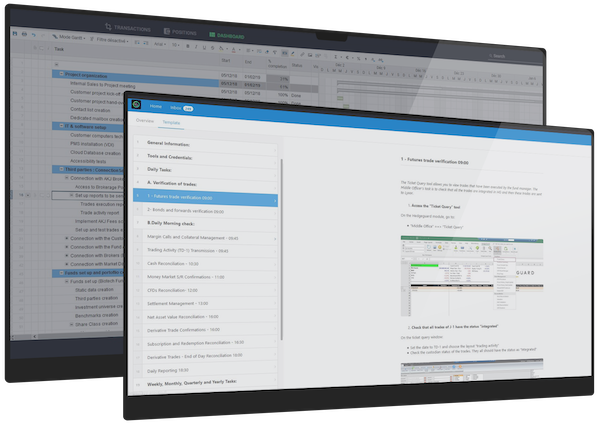

Your day to day operations under control

Our team will manage all operational tasks of your fund. From intermediating with your market counterparties to reconciling and challenging data. Key areas are covered to enable your team to focus on your trading.

Secure your operations with our dedicated team

Each of our Middle Officers is an expert, ensuring a seamless alignment of your Front Office with our Middle Office. The result: the power to focus on strategy and streamline operations.

Services Tour

Cash Management

Trade Management

Nav Management

We generate personalized reports

Our services match your process

Each of our Middle Officer is an expert, ensuring a seamless alignment of your Front Office with our Middle Office. The result: the power to focus on strategy and streamline operations.

The hedge fund industry is very demanding. We constantly develop processes to ensure the highest quality of services. Our Middle Offices Analysts design them with you and strictly apply the defined workflows.

Your Benefits

Leverage our middle office team’s

operational experience

Our head of middle office assists you during advanced stages of investor due diligence meetings.

Facilitate your relationships with Third Parties

Benefit from a comprehensive tripartite reconciliation between your Administrators, Custodians and Hedgeguard.

Streamline your processes with our experts

Operations is our domain of

expertise. We help you design, optimize and implement your own processes.

« HedgeGuard brought a unique combination of PMS and middle-office services that perfectly complements our operations. »

« HedgeGuard brought a unique combination of PMS and middle-office services that perfectly complements our operations. »