Decoding the DeFi Dilemma: Unearthing the Challenges of Investing in Decentralized Finance

The potential profits found in DeFi have become too great for crypto asset managers to ignore. Most fund managers we speak with today have some exposure to DeFi with many betting big on this asset class. However, these exciting investment returns come with challenges and risks that managers need to factor into their decision-making process.

A new collaboration is born: BitPanda Pro is connected to HedgeGuard

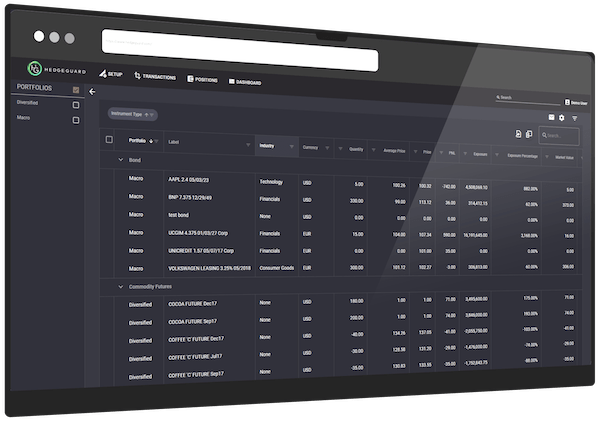

HedgeGuard, the long-established software provider dedicated to hedge funds, asset managers and crypto actors, is thrilled to announce a new collaboration with Bitpanda Pro, the leading regulated European crypto exchange. Launched in 2006, HedgeGuard provides a full suite of services for crypto fund managers and institutional players including a robust Portfolio Management System connected to…

Crypto-Assets, blockchains in different facets

Join our CEO, Imad Wardé, on June 18th for a webinar hosted by Finance Innovation dedicated to crypto! The digital assets sector has grown and players with credible solutions are now established in the French market.The solutions, both access and investment, have been improved and are reaching maturity to strengthen your infrastructures or allow you…

A journey into the future, in the earth of technology | Kriss Moukarzel | TEDxECE

Join our Head of Crypto Onboarding, Kriss Moukarzel, for a very special journey, to the heart of the crypto sphere. Through this TEDx talk, she shares her views and unique experience about the crypto-revolution we currently experiencing Watch the show! About KrissOf Lebanese origin, Kriss Moukarzel obtained a bachelor’s degree in economics in Lebanon then arrived in…

Leading crypto fund Tyr Capital chooses HedgeGuard to up-end operational management costs

02 March – Zug, London: Leading cryptocurrency hedge fund, Tyr Capital Arbitrage SP, has teamed up with HedgeGuard, a provider of portfolio management software and services for traditional and crypto asset managers, to increase greater operational efficiency across its fund activities. With HedgeGuard’s technology, Tyr Capital will have faster, more agile oversight across its order…

Post-trade efficiency increaded with FIX protocol

In this podcast, Jason Landauer, Itiviti’s Head of Network Sales, talks to HedgeGuard Financial Software’s CEO, Imad Wardé, about the middle office challenges faced by hedge fund organizations, and how the FIX protocol can help Post-trade efficiency. Small and medium-sized buy-side firms often struggle with high operational and compliance costs, which can be out of…

The ABC’s of Blockchain and Crypto

We know that #blockchain is a digital ledger that stores data. It seems complicated, and it can be, but its core concept is quite simple. A blockchain is a type of database. And to be able to understand blockchain, you first need to understand what a database is. On the other side, we hear many…

HedgeGuard and Qredo partner to overcome crypto asset liquidity lockup

HedgeGuard and Qredo are pleased to announce they have entered into a strategic partnership, combining HedgeGuard’s crypto portfolio management services with Qredo’s cross chain liquidity protocol. Connected to liquidity providers and more than 15 of the top cryptocurrency exchanges including Binance, Deribit, Coinbase, Bitstamp, HedgeGuard is a a leading crypto-Portfolio Management System combined with a fully…

HedgeGuard, the most innovative business solution of the year!

HedgeGuard, the long-established software provider dedicated to hedge funds, asset managers and crypto actors, had the pleasure of participating in the AM Tech Day event, hosted by l’Agefi at the French iconic Palais Brongniart. During this major event dedicated to Asset Management that brings together both buy side and sell-side, we had the honor of…

FinTech Focus TV: crypto show with HedgeGuard

Imad Warde, CEO of HedgeGuard, was invited by Toby Babb, CEO and founder of Harrington Starr, for the latest episode of their FinTech Focus TV: the opportunity to describe what is going on in the crypto market During the interview, Imad explains how cryptocurrencies are working but also how the crypto market is evolving. He…

Exoé and HedgeGuard strenghten their relationship!

Press Release / Exoé partnership The outsourced execution table Exoé and HedgeGuard have strengthened their collaboration. The adventure started more than 5 years ago when HedgeGuard, in a phase of strong growth, wanted to allow its clients to connect to a high performance execution table. Today, links have been strengthened with the extension of the…

One Week One Tech: meet HedgeGuard

HedgeGuard has been invited by the consulting firm Périclès Group and took the opportunity to unveil its roadmap during the One Tech One Week series. David Fernandes, Head of Operations at HedgeGuard explained the content of HedgeGuard unique offering and also detailed upcoming projects by responding to Belkacem Berrahal, Senior consultant Senior at Pericles. “Regarding…

CryptoCompare Summit: HedgeGuard was there!

HedgeGuard was excited to participate in CryptoCompare Summit 202O that took place on March 10th in London. All the crypto-players – leading blockchains, exchanges, custodians, platforms…. – were gathered to present their latest innovations and share their views on crypto-space. Our General Manager UK, Christophe de La Celle, was on stage for an exciting panel…

HedgeGuard Afterwork: revival!

https://www.youtube.com/watch?v=pZqIm7KwVpE HedgeGuard clients and partners Afterwork took place on January 23d in Paris. For this special event, HedgeGuard invited its clients and partners to share information on investment management services, and gave the floor to the French highly promising start ups SESAMm and Research Pool, specialized in Artificial Intelligence, machine learning and big data. During…

LynxStories #1: interview of Stéphane Ifrah, CEO of Napoleon X

HedgeGuard is excited to launch the first Lynx Story with an exclusive interview, CEO of Napoleon X, the world’s first crypto asset manager. Stéphane gives us his point of view about the crypto market but also advice about how launching a crypto fund. View the full interview or read it! Do you want to learn…

Portfolio Management Software: 3 sectors that benefited most from

Jenny Chang, Senior writer at FinancesOnline, shares her view about the Portfolio Management Software landscape Whether used to unite the front and middle office or to track a broad array of finances that come with stakeholders’ disparate needs and requests, portfolio management software has helped countless organizations operate more efficiently and achieve a higher rate…

Meeting in DAS Markets NYC!

HedgeGuard is looking forward to the upcoming DAS Markets, the leading institutional conference focused on crypto-market infrastructure that will take place in New York, November, 13th. During week of Nov 11th in NYC, we will be meeting with portfolio managers, investors and partners. If you are managing a crypto, a traditional or an hybrid fund…

Meeting in Consensus NYC!

HedgeGuard is looking forward to the upcoming Consensus Invest, the annual forum focused on delivering discussions on the trends and investment opportunities for crypto-assets, that will take place in New York, November, 12th. During week of Nov 11th in NYC, we will be meeting with portfolio managers, investors and partners. If you are managing a…

Highlights on Libra’s project

During the pre-launch of the ParisBlockchainWeek Summit 2020, which took place on 12th September, Bertrand Perez, Managing Director and COO of Libra, gave us pretty interesting insights about Libra’s project. First of all, Libra is a non-profit organization based in Geneva (Switzerland) which plans in launching Libra crypto-currency in May 2020. The organization is actually…

Decrypting crypto investments!

How crypto-investors can balance their risk ? What are the opportunities for traditional investors to shift to crypto-funds ? How learning machine can help portfolio managers develop their funds ? The overall institutional sentiment towards crypto in the UK/US is improving. Recently, institutional investors in crypto are all over the news with the recent launch…

A unique Portfolio Management Software for crypto fund managers!

Discover more about Hedgeguard and the way the company is transforming itself. Long immersed in traditional portfolio management, the company provides now Crypto fund managers with a comprehensive Portfolio Management and execution software.Christophe de la Celle, General Manager UK, takes the floor in an interview conducted by Etienne Brunet in Who’s behind this? #12 https://medium.com/@etiennebr/whos-behind-this-12-hedgeguard-750c8ac294c

How can Blockchain irrigate the real economy?

How can BlockChain irrigate the real economy? Imad Wardé, CEO of HedgeGuard gives us his vision on the TV set of France24. “By facilitating access to financing while simplifying administrative procedures, blockchain will make it possible, in all transparency.” Discover the complete interview: http://bit.ly/2FNOoMq

BlockChain, internet of money

Imad Warde, CEO of Hedgeguard and guest of the “economy” program of Radio Classique describes the principles of Blockchain and its impact on the financial industry. “The BlockChain makes it possible to improve operations tracking, to desintermediate 3d parties while accelerating exchanges”. The direct consequence is a decrease in transaction costs. For all these reasons,…

Insights about a Crypto Hedge Fund strategy with Light AI

During the ParisBlockchainWeekSummit which took place in Paris, Station F, from 16th to 17th April, Luigi Li Calzi, Managing Director at Light AI gave us insights about his Crypto Hedge Fund’s strategy, Light AI is an investment management company, based in the US, that develops proprietary machine learning algorithms in pursuit of absolute returns. As…

Understanding a STO: Montessori-HeidiDom project

During the ParisBlockchainWeekSummit which took place in Paris, Station F, from 16th to 17th April, HeidiDom/Montessori, an international network of 30 nurseries, presented its Security Token Offering. A blockchain project anchored in the real world: child care! Delphine Deshayes, Western Europe Business Director at Montessori/Heidi Dom and Céline Moille, Associate Lawer at Yellaw-Bitlaw give us…

Come join us at the first London CryptoBrunch by HedgeBrunch!

We’re excited to be speaking at the first CryptoBrunch by HedgeBrunch! Christophe de la Celle, Head of UK Office will be discussing the road to institutionalising your Crypto Hedge Fund. CryptoBrunch by HedgeBrunch 12 Hay Hill, Mayfair 8am-11am 17th May Buy Tickets Join us for this morning networking and panel discussion “CryptoBrunch” event to cut through…

Join HedgeGuard at ‘A Regulated Cryptocurrency Fund Solution’

HedgeGuard is looking forward to participating at SGGG‘s ‘A regulated Crypto Currency Fund Solution” in Zurich! Tuesday 22nd May Zunfthaus zur Saffran, Zurich To register, please email [email protected] We will be discussing the institutional solutions for Crypto Hedge Funds and how to pioneer your new hedge fund launch strategy ranging from regulatory to technology solutions. To…

Insights for Cryptocurrency Fund Managers & Investors

HedgeGuard will be participating on a panel to discuss the operational priorities for Cryptocurrency Fund Managers. We will be detailing the requirements for launching your Crypto Hedge Fund. Join us to hear understand how to take your fund to the institutional level and view a live demo of our Crypto Portfolio Management System. Cryptocurrency Fund…

Asset Management Technology & Innovation Outlook 2018

Imad Warde, HedgeGuard’s CO-CEO & Founder shares his outlook on asset management technology, the infrastructure surrounding an asset manager’s Investment Book of Record and their Portfolio Management System: How has the technology assisting asset managers evolved in recent years, and what has been the main driver of that change? In the last ten years internet…

Asset Managers and their Operational Edge

Edge, the continuous focus of the portfolio manager, is now being identified and achieved in areas that span outside the traditional investment management remit. This trend is also taking place in an increasingly challenging environment. Long-only managers for example are faced with heightened competition from low-cost passive and new systematic products and it has become…

How to choose your new Portfolio Management System

By Christophe de la Celle, Head of UK Office & Global Business Development – HedgeGuard Scaling up. Unlocking “operational alpha”. Building an institutional investor and regulator proof infrastructure. These are all key considerations at the forefront of fund managers’ agendas. New technology has allowed funds to achieve increased operational efficiencies which have fed into front…

Defining an Asset Manager’s Investment Book of Record

Traditional IT architecture involves segregated front-office and operational systems, furthermore these systems can be specific to individual asset classes; equities, fixed income, derivatives and structured products. Products are increasing in complexity and higher regulations require portfolio managers to take a consolidated view of their portfolio holdings. Taking a consolidated view is proving more difficult with…

HedgeGuard’s Expansion Across Regions & Welcomes a New COO

As he often says: “I’m here to help!” 2017 has been an exciting year so far here at HedgeGuard. First to be mentioned: HedgeGuard’s Expansion Across regions We’ve the opportunity to work with a wide range of new hedge fund and asset management clients, each with their own investment strategies, objectives and requirements. Ensuring that…

How To Ace Your Hedge Fund Investor Due Diligence

Raising AUM is a tough endeavor and one that has become even more so post 2008. Investor roadshows are akin to marathons and “hit ratios” take all their importance. Once the initial screening stage (where team pedigree, strategy and returns are discussed) has been successfully passed, investors will want to dive deeper through the means…