Overview

Enhance the core of your operations with

a powerful Order Management System Trading

Our investment management system is designed to deliver the analytics, views and reports you need to stay on top of your strategies. HedgeGuard PMS is engineered by seasoned professionals in the Order Management System industry.

Product tour

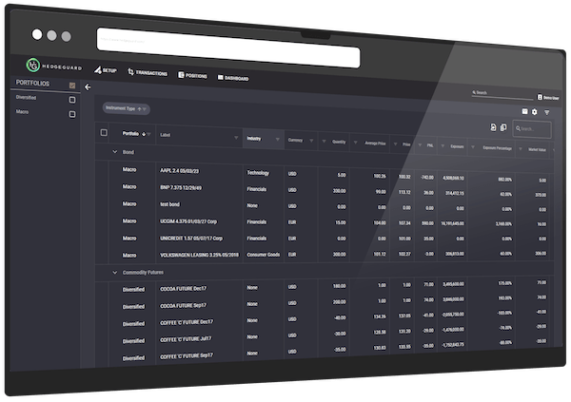

Front Office

Middle Office

RISK AND REPORTING

Streamline all your front-to-back operation with a comprehensive Order Management System Trading.

Our comprehensive software provides you with all the key features to manage your portfolio : fast order simulation, full automation of trading fees or order life cycle management.

As a result, HedgeGuard Portfolio Management system allows you to:

- Settle off all positions on the same security

- Simulate an order to attain a target exposure

- Simulate an order by increasing exposure

- Check re‐trade and post‐trade compliance

- Route orders to EMSX or other counterparts through Fix connectivity

- Set up broker, and account defaults

- Handle fees by security type

- Handle the underlying level (derivatives) in % of notional or amount per share

- Manage any kind of fees: broker fees, custodian fees, dealing desk fees, research broker fees, exchange fees and other fees. Fees can be capped and floored.

- Check the order status that is automatically handled: pending, transmitted, partially filled, filled, cancelled, closed

- Monitor trading activity thanks to our end user-configurable blotter.

Your portfolio evolves with new activities to cover? Do you intend to launch a new fund? Do you consider outsourcing your middle-office activities? We constantly improve your services and provide modules configured to match your needs.

Do you want to learn more about our Order Management System? You can watch our videos or discuss with our experts!